Make ICOs great again

I’ve been thinking for a couple of months that the way projects currently distribute their tokens to retail is broken and that ICO and its siblings could be a valid alternative. The recent tweet by ceteris encouraged me to sum up my thoughts on this end (and there were many other good takes on twitter for the last few days, so I had to hurry up with my essay).

First, let’s walk briefly on the current meta and what’s wrong with it. Points. Almost every single protocol aiming to launch a token in 2024 implemented a point-based reward system. Some of them did it creatively (I know dozens of people who enjoyed Blast’s casino-like spin mechanics). Still, most of them just distribute points to a user daily based on how much of the capital/volume the user provided to the protocol. As people are coming to the protocol, it helps in further fundraising (VCs are big fans of «traction», and you could game them that it’s all organic). As a result, projects and VCs are pretty aligned on choosing this route. From my perspective, such a mechanism looks more like a socially approved ICO/LM (liquidity mining) Frankenstein rather than an excellent initial distribution mechanism. The core cons are:

— non-transparency and asymmetry of information: many projects decide not to disclose the criteria for getting points, thus trying to avoid exploiting the protocol. While it allows developers to fine-tune the protocol based on the users’ interactions without clear financial incentives, there are many complaints about such a design. For example, in Hyperliquid, one of the most popular derivatives platforms, many users are collaborating in chats trying to understand points dynamics because it seems to be really non-trivial (as it depends on whether the particular user is in profit, how the vaults performed, volume, OI, etc.). This asymmetry of information and puzzling different pieces altogether is a double-edged sword. On the one hand, it could be viewed as a brainteaser you need to solve to optimize your attitude, which could be fun (although it is a question of whether such behavior of «solving» is desired from the protocol's perspective). On the other hand, uncertainty in the earning mechanism drives a lot of negativity in discussions between people (and their views on the protocol and fairness of the points distribution). Moreover, such a design leaves a lot of space for low-ethics insiders to game the protocol, and we saw such examples in the past.

— the user attention span is short, and the endless nature of most point farming programs (without a clear end date) makes it worse. In a world where there is a protocol with a new point-based system every day, it is super hard to stay relevant over time (check fees section). Attention is one of the critical ingredients for success, and your quasi-infinite points program (from a user’s perspective) does not help you capture it.

— inflated expectations: people expect points == tokens, and those tokens must be worth many $$$. Moreover, early examples of successful protocols that first adopted this meta put high expectations on every other playing the same playbook. The ridiculous amount of e-beggars (airdrop farmers) is already in your protocol, and they are moaning for their checks. Most people are extremely bad at making any sort of predictions (especially when optimism is prevailing in the market), so once you do not meet people’s expectations, you’ll likely be forgotten and obfuscated. We have not seen such dynamics yet (because most of the protocols are still running their infinite programs), but I’d expect we will see many cases in H1 2024, especially in projects where its core value prop is farming its own token or farming a high-status ponzi on top of it.

— fake/inorganic users. I barely touched a point about airdrop farmers (I really like the word e-beggars, though) in the previous paragraph, but those users do not only inflate expectations and try to game you. They also could provide a lot of noise to your core product. As those users are driven only by a short-term financial outcome, they could affect the core metrics of your protocol and lead you to the perspective that PMF is reached and/or to the decisions that could make sense in the short-term but would be painful in the long-term, once those users churn.

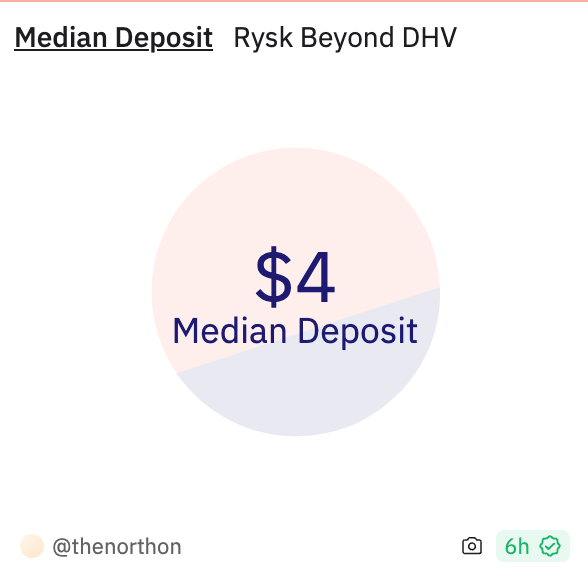

The median deposit for the protocol with $2M+ TVL is $4. Should they optimize for such users?

While I’m sceptical about the initial token distribution driven by strictly point-based systems these days, I suggest that metrics-based LM programs with real tokens still work these days and could drive the protocol’s sustainability and growth (check the vault’s performance since this program started without ARB incentives). Moreover, using points as a loyalty program (no direct financial incentive, but rather some status-specific features, perks and other creative and engaging bonuses) could make sense and be a potential angle in increasing long-term retention metrics for protocols.

So, are ICOs really worth resurrecting those days? Let’s examine the core features of such a distribution mechanism:

— the democratization of capital formation. I guess it is one of the few real PMF use cases we have seen so far. As with every truly open and disruptive technology, there are a lot of abusers/scammers digging around it, but the ability to fund an idea without being an elite part of society is tremendous and breakthrough. Such siblings of ICOs, as LBPs, could even offer a prolonged price discovery, wider distribution and sybil-resistance (which is the primary sin for every other method of the initial token distribution).

— distribution. This feature is linked with the previous one, but I’d like to mention it separately. Community is one of the core pillars of a successful crypto project, and ICO could be a great supportive tool for this task. Most of the projects optimize for marketing and liquidity during their TGE event (thus, most high-profile projects prefer ICO-like activities those days go through Binance Launchpad or Coinlist), but there are other options, too. One decent example from the past is the initial TGE of The Graph. They had several phases, and gave their early contributors priority access (aka a guaranteed spot). I like such a design, as it is a logical stimulus for those who contribute to your project during its early steps and are willing to take risks with real $$$ rather than industrial-grade farmers who do not care about your project. Another good example is Perp Protocol. They chose a simple LBP mechanism, and I guess much of their success and early user attention was driven by this decision to choose such a distribution mechanism (as well as the novelty of their tech, vAMM, and the desire to trade perps by degens).

— make your early believers rich. Another attribute of ICO is to provide a chance for a stranger to be early and be right (sometimes even on a big check size). Yes, it may sound cynical and profit-maxi, but most crypto users view crypto as a way to earn more $$$ and make it. So, if you can succeed in this goal with your early users who took risks, they will likely become your most passionate shepherds.

— fast feedback loop. In one sense, we could say that in ICOs, people are betting with their money (that makes them a sort of prediction market, although a very fragile one because the user’s perception pre-ICO could be easily gamed, but, eventually, «the truth» will be settled). However, the real power is that such users care much more about the particular protocol because of their clear financial incentives. Those users are more willing to provide candid feedback than those who are just farming another protocol points. Moreover, the fact that real value exists in the system within a short period rather than an endless point-farming system allows you to analyze your project's trajectory more transparently and less-noisy.

— attention. My take here is that in the world of hundreds and thousands of Frankensteins loyalty programs running, the method of distribution could be your edge. If appropriately designed, the TGE event could be a powerful mechanism to drive users to play with your protocol, and further incentive programs could be helpful to capture those users and make them your power and loyal ones.

— extra earnings. Probably, most of the protocols that were favored by VCs do not suffer from lack of capital, but it is better to have an additional war chest than not, especially if you compare ICO vs airdrop (where you basically give people money for «legitimacy» and «decentralization»).

— fixing a broken model. I suggest you read the whole thread before exploring this paragraph. Wassie is nailing down the old-known fact: many VCs and projects are abusing the low float/high FDV way of distribution. This meta is a sort of cheat code for any credible projects. They pitch you a narrative, hedge their exposure, and sell you their freshly unlocked tokens (or re-sell them via OTC). I do not propose a world where every capital formation should go via ICO (as it’s just a bad and utopian idea, and we will likely see much more failures in startups, which is the usual case with overcrowded angel-only rounds, where no one really cares about the project as their size is too small), but we should advocate for a bigger % of supply for public allocations.

Wow, so many pros. Why did people stop doing ICOs? I guess the main stopping factors are:

— legal overhead. Well, no one wants to face legal scrutiny and obligations for building your beloved decentralized protocol. Especially when the potential outcome (and without legal clarity, you could not be confident that you’re not in the risk group) is a no-go for many builders (especially US-based). I’m not a legal expert, but I believe that there are still numerous ways to create a proper structure (and we see a ton of examples where projects were able to sell their tokens via ICOs). I guess the success here is just the function of your desire and capability on the legal side, and there are a bunch of folks in the space (VCs, advisors, etc) who could be helpful with figuring it out.

— optics. As we all know, most of the past ICOs were cash grabs (and we should be fine and accept it as the industry matures). So, credible builders are frightened to be associated with such activity. Although the recent meta is putting retail users (especially small and less-insider ones) in an unfavorable position, my take is that ICO could be viewed and positioned as a much fairer way to distribute your tokens. The pendulum could (and likely will) swing in another direction, but at the current stage, optics for launching ICO vs launching another points-based system look more pleasant for the former option, in my opinion.

If I were the project's founder these days, and my end goal would be the project's long-term success, I'd be eager to explore alternative ways of token distribution rather than those socially approved ones. While having some downsides, ICO and its analogues could be a powerful way to drive attention and create a robust community, which could be the basis of your success. However, I do not see ICOs and point-based systems as completely orthogonal. Creative builders could mix them, attract passionate community and create pretty solid initial distribution. If you’re interested in chatting about it — let me know. I have several ideas for combining those two incentive designs, and I plan to elaborate on them in further writings.