How not to fuck up with your token launch

Well, new token launches did not feel great in 2024, and twitter is obsessed with it. There are a plethora of posts and warnings that you should not touch any new token launch with a 10-foot pole. How did we get here?

Earlier this year, I shared my skepticism about "Points" as a panacea distribution mechanism for capturing the retail market, highlighting issues such as short attention spans, inflated expectations, asymmetry of information, etc. These concerns have become more evident as people face the drawbacks, and some dead bodies will come in the following months as they have to finish their endless points programs. Consequently, founders are exploring new ways to drop their new shiny tokens and make people talk about them. This essay is an attempt to take a look at the current state of token launches and figure out what is the new hot thing from Brussels town that people chat about in closed doors when they do not try to pitch you some FHE/TEE/Chain Abstraction word salad (spoiler: it’s just ICOs with extra steps aka node sales), and how feasible this concept really is. In the final part, I will touch on what things make sense to optimize for as a project when you are planning to target retail participants, and provide some ideas and hints for founders on how to approach this.

So, it’s time. Whether your metrics look super sassy, PMF is here, and all e-beggars (including your long-supportive VCs) are spamming with «wen» in the discord and dm, or you just think that successful token launch is the missing puzzle for your project to shine finally. Hold on for a second.

What is the thing people in crypto are obsessed with right now? Yes, pumpdotfun. This article is not another attempt to make a pseudo-intellectual take on how meme-coins are the future of the culture/finance/etc, but about understanding forces why people are tirelessly bidding on those meme-coins day by day, although chances to succeed are neglectable to zero. The core thing is how retail participants view the broader market besides meme-coin trenches regarding potential sufficient (or even life-changing) upside. This everlasting dynamic, where people continue to bid on new meme-coins and broadly avoid any serious projects, could indicate that people do not believe they could make it, aka change their life by bidding on another VC-backed coin. Although, in reality, they are very much the same things, and over time, people will finally get it. A short lesson here for our further conversation — as a founder of the next big thing with a token, one of the critical tasks is polishing your messaging and perception for the retail audience.

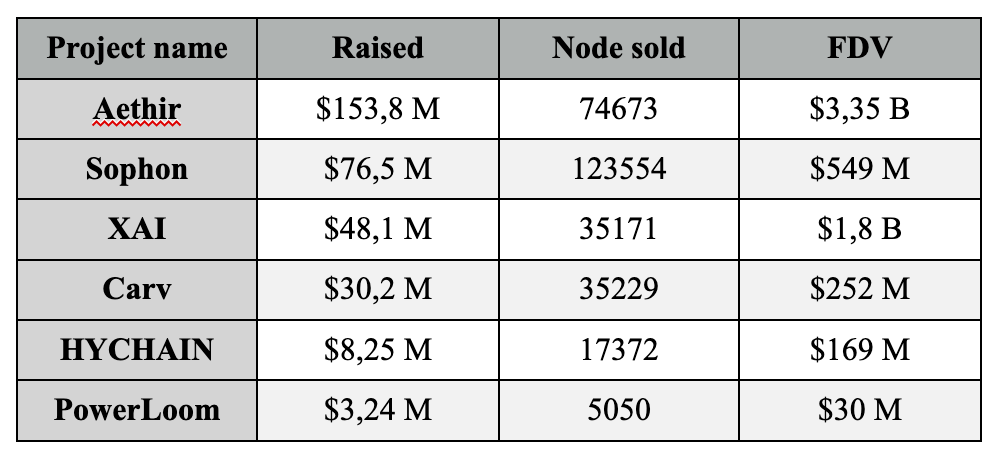

Ok, let’s get back to the table. Points have done an abysmal job of capturing people’s attention and retention metrics for the last few months. After the initial airdrop, there is basically no single person who is interested in buying those free tokens from their neighbors. So, how do people think to fix it? Node sales. Well, it’s a sort of ICO with extra (greedy, from my perspective) steps. Usually, it works this way:

— You’re building some future of infrastructure/middleware that would be critical for the next generations of application developers. As a result, you have a set of nodes/network operators that either come to some sort of consensus or do some other essential type of work (indexing, etc).

— You’re reaching all fancy launchpool and exchange platforms, all types of KOLs and even VCs with a compelling financial offer, allowing them to buy locked tokens in the form of a node. So, the amount of tokens per 1 node is predetermined, but the participant could purchase whatever amount of nodes is available.

— You make different tiers (basically, pricing and capacity) for different channels of distribution, they help you in promotion, and selling those slots for your future of blockchain infrastructure. In most cases, a buyer does not even need to run a node, as he could delegate his «node», aka locked tokens, to some professional operator.

As there are almost no opportunities for retail to be early and bet in size on early opportunities, those node sales are very lucrative for the projects.

Don’t get me wrong, some aspects of those sales are good to go. For example, I do not have any problems with locking willing long-term retail participants, extending the project’s runaway via retail money or boosting your brand awareness. Your chief legal officer would likely support this idea more than plain ICO or LBP, as you sell «nodes», not tokens. Unfortunately, the concept of tiers and their distribution often mirrors the current meta, where the upside is mainly captured privately. In node sales, this happens through the first few tiers, which are generally not available to the public. Node sales often include endless tiers and gate-keeping lucrative early tiers for influencers and VCs, while retail participants can only join the billion FDV tiers, maintaining the same status quo. And, if you play the same old game and expect a different outcome, I have pretty bad news for you. Another concern I have about node sales is that almost every single late-stage infrastructure project I talked with in Brussels (10+) is considering this option as the main for its token launch strategy. In a world where every single ZK/AI/DePIN project makes a greedy node sale, what is the likely outcome for the project and its supporters?

Before exploring some ideas on how to design a better system for retail distribution, let’s point out things that are worth optimizing for as a founder:

— extending runaway. Big raises could be a double-edged sword, although giving your project additional years of a runaway is a good thing. More time to experiment means more chances to win and become a thing.

— rewarding real and early users. No one opposes giving a good chunk of the upside to those who really use your product or provide some valuable work (not discord farmers, translators, meme copy posters, gmers that joined after your round announcement, folks who pretend to be github contributors, or just Eigenlayer team), but how to distinguish them? Well, there is no silver bullet, and it highly depends on what your project actually does. From my perspective, there are some simple underutilized methods for understanding the real users, such as checking L1 nonce and median user’s metrics, while others (for ex., the meaningfulness of transactions, utilizing others sibyl lists, or asking people to build something useful on top of you) usually require much more time and resources. The idea behind rewarding those types of people is that they have to show some sophisticated behavior with your product (which is not limited to users only) and be rewarded. It is ok to put lockups for this cohort of users as you expect them to be for the long-run.

— better price discovery. The biggest problem with the low supply high FDV meta is not about a low supply (as many of the successors of the previous cycle had such a feature, ex., The Graph, Avalanche, Solana), but about the valuation and who controls unlocked tokens (for shady projects it’s usually non-trivial to find out as they typically try to obfuscate it). Price discovery in public is much more efficient and healthier than discovery in a private market with deceptive, impatient, delusionary, and rigged participants. Therefore, having a bigger portion of tokens to be tradable compared to waiting for 20x of the upcoming supply unlock next year, is definitely a metric worth considering.

— people’s perception/narrative. Well, that’s not the best and the only thing to optimize for, but that’s the thing people complain about and talk about all the time, and it affects the perception of other people of your project, and, surprise, token price and that all affects your team, you, etc. The most significant motivation for people to buy fancy magic coins is seeking opportunities to be early, and it’s hard to criticize them for not being excited about another high FDV project. To be successful in the long run, you’ll likely have to build a cult, a very passionate community of supporters, and there is no better way to create such one than to make early believers rich (study LINK marines).

Ok, bro, the speech is so persuasive, so what are some good and bad practices on how we should design the token launch, and what are unexplored ideas around vesting/lockups in general:

— airdrops in their current form suck and are not worth it. There are a few clear points against it: a) they are not very effective spending of your marketing capital, as the retention rate, customer acquisition cost, etc., are super low, and there are a ton of industrial-grade farmers (it’s a late 2022 thread, and things only have got worse on this end since that time), who will dilute your actual users. People basically claim and forget about the project b) by giving out people free money, you may exclude many potential buyers as the perception of «I will not buy a token that some people sybilled/got for free» is real and stays for a long time after the initial airdrop c) the asymmetry of information besides insiders and retail in what should you do for getting an airdrop and who really get those tokens is tremendous. A much better strategy in that case is to let people risk their capital in a transparent manner (more details below). As a project, you get much more attention and willingness to spread the word about it, and more alignment (what a cursed word nowadays) than dropping free money.

— leave liquid upside for the retail. All those perpetually bleeding charts (and I’m saying about XYZ/USD, not even about XYZ/ETH or XYZ/SOL) do not look great, and people are avoiding touching any of those. In this business, your most desired currency is people’s attention. So, rather than doing another stupid airdrop, there is much more logic in doing a plain ICO with a limited hard cap per user, LBP or Dutch auction (in the end, all participants have the same price). As price discovery in open markets tends to be more efficient, providing a sufficient amount of tokens for this cohort of users is logical. That cohort of users should not have any lockups, as it not only shows small dick energy from the project (I don't see any reason to prevent people from trading their newly purchased tokens, other than the concern that they might sell them) but hurts price discovery. Let some people sell and miss out on your fantastic project, and rebuy it with size at a pico-top.

— be creative with your promotion campaign. Projects are copycatting all those point-based systems from each other, and in the end, the real consumer cannot distinguish them. In my previous essay, I mentioned that Blast did some part of their job well (as many people enjoyed unlocking all those loot boxes during the first phase). Another recent good example is Infinex with its Craterun, a gamified opening of loot boxes (the most dominant and working technique, although hated in the gaming community) with nice UI and transparency around what people could get and the timeline of the event. However, they were unable to deliver the integrations and the product before the end of the Craterun, so they were not able to make all attracted TVL sticky, which is a big miss, from my perspective. Be brave enough to experiment with your approach; don’t do what others do for your project, especially if you see signs that it does not really work. The secret source is adding project-specific creativity that could boost your engagement metrics and mindshare about your project.

— be creative with vesting and lockups. When speaking about creativity for vesting and lockups, people usually tend to push some sort of KPI lockups, aka reaching $100B TVL/$250M fees/solving the world’s starvation and then unlocking team and VCs tokens. I think that pure KPI-based unlocks won’t work. First, people could (and will) play the metrics if they have enough incentives (and having liquidity is one of those). Another disincentive to push pure KPI-based lockups is that one of the main props/features for early-stage crypto startups is a bigger chance of liquidity compared to web2. If you kill this feature, it will affect valuations and raises, as well as the end products (although for the last point, it's not a 1:1 correlation, of course, but you would be super naive to disagree that such a connection exists).

However, a combination of KPI lockups with timing lockups could work. For example, some tokens could be unlocked once a major milestone is achieved (a huge place to abuse, as I mentioned above, but on the other hand — more token supply, more fair price discovery, and it’s not the only one thing that you rely on for your token supply), some are purely time-based vesting. Another underexplored thing about lockups is what you could call conviction-based vesting. Let early supporters claim all their tokens as early as possible but with penalties. The remaining amount could be transferred to the high-conviction early supporters, treasury, etc.

To give you a better picture, let’s take an example. Imagine an investor with the 1-year cliff and 2-year linear vesting that lost all his convictions in the project after 1,5 years since TGE and is interested in exiting his position fully. In a classic vesting schedule schema, he will be able to claim 6 months of unvested tokens, plus he has to find an OTC deal for the rest of the size or sell all freshly unlocked tokens every month for the next 18 months. From the project's perspective, none of these outcomes (trading locked tokens in a shadow, a non-efficient market, or perpetually pressing the sell button) is really the desired outcome.

But what if we allow that investor to claim 6 months of vested tokens plus give him some proportion of his unvested tokens (and make them liquid for him), and send the rest of the left illiquid tokens to other parties mentioned above? In that case, you may need to have a short time lock period for locked tokens to become unlocked (a few days) to let other market participants stay aware of such an event and act accordingly. The outcome of such a feature is that we have more token supply on open and liquid markets (better price discovery for a token) and reward long-term-oriented players. There are several caveats on how you should distribute tokens for those who claim during cliff (and whether they could), what proportion of unvested tokens could become liquid, time locks for those freshly liquid tokens, and a few others. Still, the outcome seems more pleasant for the project and sounds like something you could optimize for.

– programmable and narrow airdrops. Although I'm not a fan of airdrops in their existing design, there are several interesting underexplored ideas. The first is about utilizing KPI-based metrics beyond locked tokens and vesting. What if the user's airdrop amount is based on the closed price of the Dutch auction (aka public sale), so airdrop-eligible users receive more tokens via airdrop in case the project reaches some traction and market perception? Or your DEX volume for the first 6 months could be a metric that decides the size of the airdrop for early participants. Also, making airdrops much narrower and opinionated is worth considering (as you have much more attention per person rather than distributing your tokens to every discord member or onchain sybil with $100). There is a world where rewarding 500 power users is better than spreading the same airdrop budget across 10,000.

— locked tokens (VC, team, etc) should not earn any yield for securing the network (aka staking) at all or earn fractions of the yield of those who stake unlocked tokens. Oof, things got super spicy here. My take is that inflation should reward only those users contributing to a valuable network task (aka securing the chain) and bearing the risk of holding the asset and locking it up for the yield. Some will say that in the case of the zero yield design for locked tokens, there are no financial incentives to run a validator for insiders. As a result, only a tiny percent of the supply is staked, negatively affecting the network's security.

From my perspective, those risks are very overrated, especially for young networks, where you could easily coordinate stakeholders in case of a major update/fork need. Another approach related to creative vesting is having insiders lock their tokens to start their vesting schedule. They would need to stake or delegate their stake to unlock their tokens and earn the ability to unlock assets instead of earning yield. Moreover, the foundation of the project could launch a validator’s program, where the foundation chooses/sells a spot in a set of validators for the next (actually, useful node sale), let’s say, two years. As most lockup schedules today are one year, you'll have a bunch of tokens from different stakeholders unlocked at the end of the program that could generate a yield for the validator and motivate him to continue securing the network. To secure the network, insiders could easily delegate their stake to such providers during the lockup period. After the program, those program’s tokens for a particular validator became their own.

Another angle for solving the «not enough security at day 1» problem is to have some unlocked insider tokens (10%, for example) on day one that could be staked for the yield (or dumped in your favourite CEX). Such design expands day one token supply, although as far as I know, many VCs (primarily, USA-based) could not follow such design for regulatory optics. Personally, I’m not a big fan of liquidity for insiders on the first day, as the incentives to cash out, especially for the early believers, could be substantial.

— do not play decentralization theater early. Yes, the end goal of crypto protocols is decentralized, censorship-resistance primitives, but that's not a thing you should be optimized for on day 1 of your token launch. All these narratives about community ownership, especially in making strategic decisions for a freshly launched protocol ((which likely hasn't fully achieved product-market fit and needs several iterations), are just a soft scam. Your protocol should be opened for new ideas and inputs, but giving the power of the ship to a bunch of degens that suffer from short-term optimization and have very little experience in operating anything is just a one-way ticket.

— do not optimize for a «better market» to launch your token. There is much more sense in the phrase «the best time to launch your token was yesterday, second best isnow» than people think. Attention is the most limited resource in this industry, and the financialization of every user’s click (aka potential airdrop, liquidity mining, etc) does not make it less scarce. When music is playing (prices up only), and every project is seeking retail attention, many do not get it, as there are myriads of opportunities for a user. Moreover, launching during the blood in the streets gives you free leverage on being a market beta in case this industry (and your particular protocol) is not going to straight zero.

All in all, if I were a founder of a promising startup looking to launch a token, I’d make some combination of a sale for those who showed sophistication and alignment with the project with lockups and a broader market sale via LBP (as they have most volume since the beginning of the year, $220M raised by Fjord for 8 months this year) or one of the platforms (Coinlist, Tokensoft, Jupiter for solana-first projects or any new incumbents) without lock-ups and with one fixed-price.

Money raised across different launchpad platforms this year

The particular design is subject to discussion case by case, but I would split the sale into two phases. For the first phase, I would allocate up to 20% of the token sale supply and make a plain capped per-person ICO with locked tokens for those I distinguish as power/sophisticated users. The good example is Graph sale, where they allow Indexers that serve the network to get a sufficient chunk of the tokens (25% of the whole public token sale). Then, for the second phase, I would do LBP or Dutch Auction for the rest of the supply, depending on what particular thing I'd like to optimize for. The former is optimizing for funds raised, as more strategic thinking and speculation ingredients exist because, basically, LBP is very similar to trading. However, most of the projects are down horrendously, which, from my perspective, speaks more about the quality of those projects and market dynamics rather than about the efficiency of such methods. The latter token sale format likely allows you to raise less funds but in a fairer manner, as every single participant will have the same price. Personally, I like the second option more. One of the great recent examples of such a sale is Sanctum.

If you’re eager to chat about implementing or tinkering out any of the ideas mentioned in the article — feel free to dm me.